Scipio Swanlaab SF SCR

“Scipio Swanlaab SF SCR invests globally in Search Funds”.

What is Scipio Swanlaab SF SCR?

Scipio Swanlaab SF SCR invests globally in Search Funds — the world’s highest performing asset class over the last 25 years. As such, the fund seeks to attract and invest in talented individuals or teams that will search for a business to acquire and subsequently lead. It provides funding for both the search phase as well as the eventual acquisition of a target company. The Fund is sector agnostic and expects to purchase growing businesses with competitive advantages at attractive valuations.

About us

Scipio Team

Investment Team

Aitor Sancho

MANAGING PARTNER

Sara Pérez

PARTNER & OPERATION MANAGER

Alejandro Moya

GENERAL PARTNER

Monte Davis

GENERAL PARTNER

Swanlaab’s Team

Mark Kavelaars

MANAGING PARTNER / CO-FOUNDER IN SWANLAAB

Verónica Trapa

MANAGING DIRECTOR IN SWANLAAB

Juan Revuelta

PARTNER IN

SWANLAAB

Scipio Swanlaab SF SCR

Investment Thesis

Worldwide

We bet on the most talented searchers, as one of the keys for success, independently of where they come from.

Investment

Average Investment of 30k€ during the search and from 300k – 1.5M€ when the Acquisition arises.

Philosophy

We believe in the Search Fund Community, where searchers and investors share their wisdom and work hand by hand for bringing success.

Search Fund Model

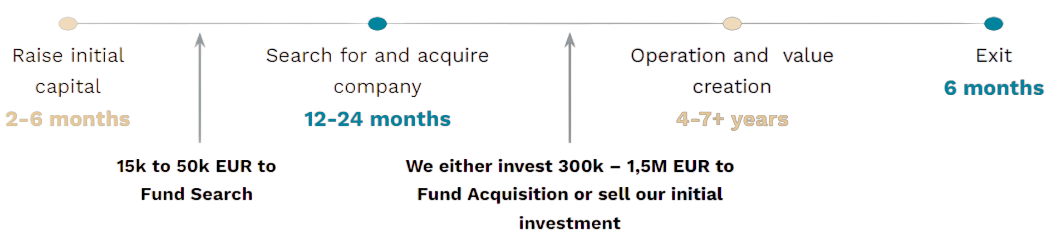

The term “search fund” originated at Harvard Business School in 1984, was popularized at Stanford in the following 10 years, and has been steadily adopted by business schools and entrepreneurs around the world. A typical search fund progresses through four stages – Stanford Search Fund Study:

A search fund is an investment vehicle to allow seasoned executives the opportunity to search for, acquire, manage and grow a company.

Stanford Selected Observations 2022 shows a historically “aggregate pre-tax returns of 35.3% internal rate of return (IRR) and 5.2x return on investment (ROI) “ among 526 first-time seach funds.

Search Fund Studies: