Strategy

Taking advantage of succession issues, Scipio invests in Search Funds and acquires growing, profitable and consolidated SMEs directly and through its investment fund.

SME Succession Issues

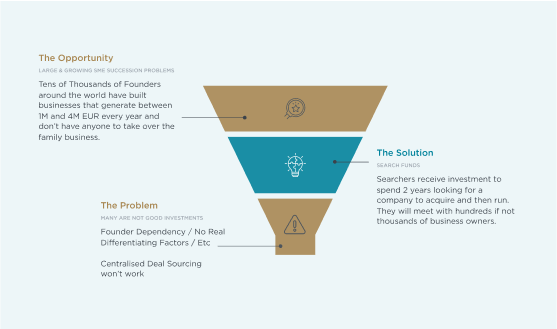

Increasingly, successful family-owned businesses are facing succession issues. The founders are looking to retire and move-on but don’t have anybody to take over. Scipio takes advantage of this global trend by matching talented leaders with business owners to access attractive growing assets at extraordinary prices.

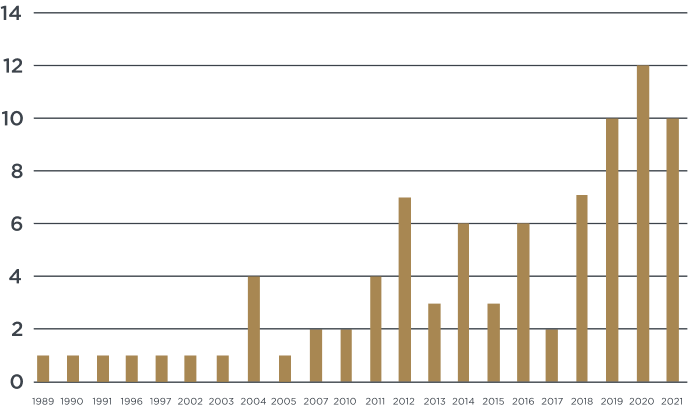

Share of SMEs facing Succession Issues

Serial Acquisition

Scipio is a serial acquirer. It seeks to grow its business through the sequential acquisition of companies with a commitment to long-term ownership. In our approach, the emphasis is placed on patient and thoughtful investment strategies rather than quick, profit-driven gains. We believe in holding businesses for extended periods to maximize returns and foster sustainable growth. By adopting this patient capital mindset, we aim to create enduring value and contribute to the long-term success of the acquired companies. In essence, Scipio's serial acquisition strategy is not just about immediate financial gains; it's a deliberate and personalized approach to building a resilient and successful business ecosystem over time

Decentralised Organisation

Scipio manages its acquisitions in a decentralized way. It has built a network of autonomous units and promotes flexibility and seamless integration. Each unit has the autonomy to adapt to its market dynamics, allowing for efficient acquisitions without disrupting the overall structure. This model encourages innovation and efficient resource allocation, enabling talented individuals to thrive within an environment that values individual contributions and collective success

Search Funds

As part of its acquisition strategy, Scipio invests in Search Funds. The term “search fund” originated at Harvard Business School in 1984, was popularized at Stanford in the following 10 years.

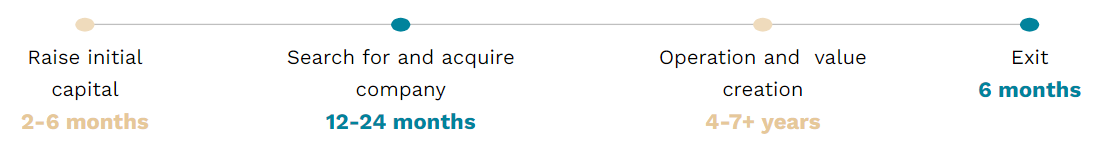

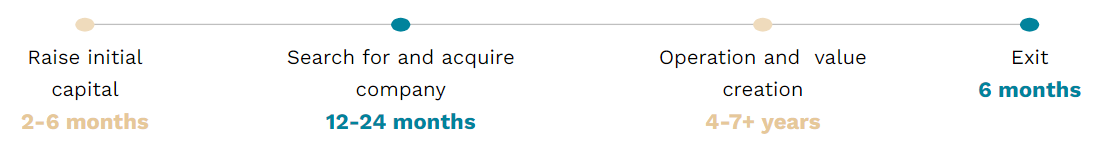

A Search Fund consists of an individual or team who will spend up to two years trying to find a company to acquire and subsequently run. A typical search fund consists of 4 phases

Search Fund Process

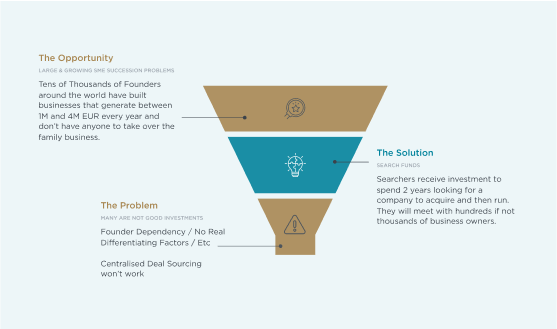

Accessing Difficult to Find Opportunities

Search Funds -- by decentralising deal sourcing -- solve the fundamental challenge that while there are many, many SMEs that have a history of generating profits and cashflow, most do not make good investments and an investor needs to review hundreds of companies to find a single good acquisition target.

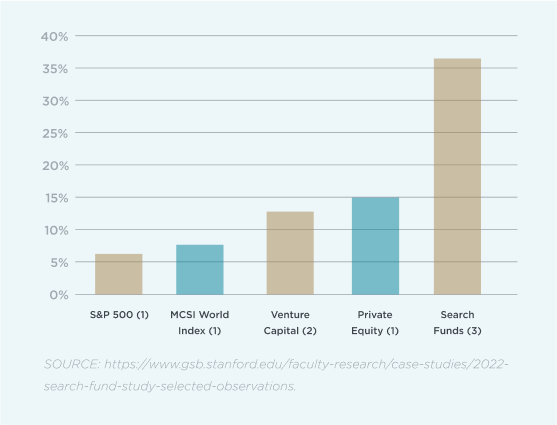

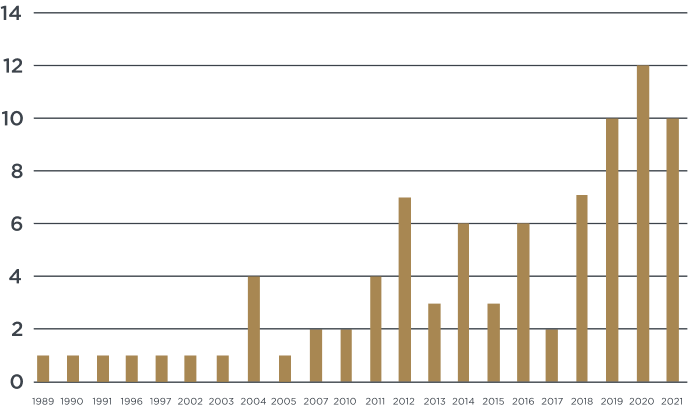

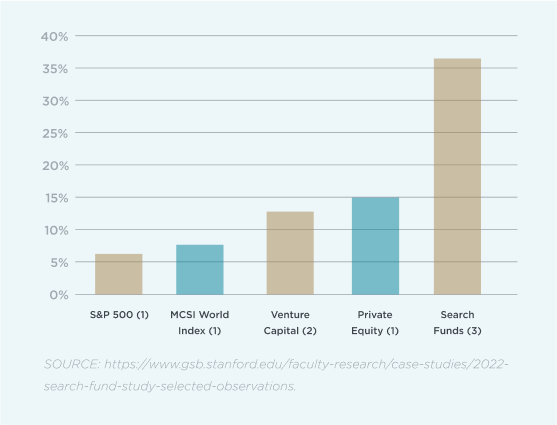

Historic Returns

Search Funds access acquisition opportunities not easily available to traditional investors which leads to acquiring great assets at extraordinary prices which delivers superior returns. With an aggregate IRR of over 35% and aggregate MOIC of over 5x, Search Funds are the highest performing asset class over the last 30 years

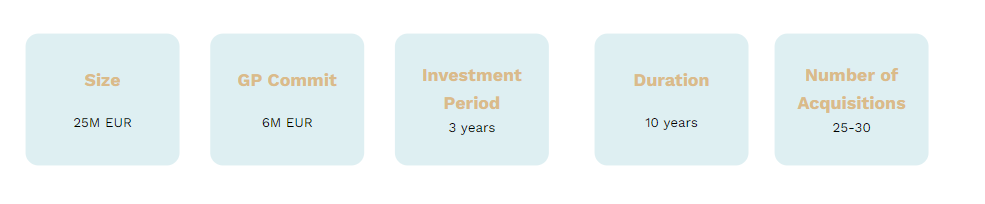

Scipio Swanlaab SF SCR

To drive its Search Fund investment strategy, Scipio has partnered with Swanlaab Venture Factory SGEIC to launch a Global Search Fund Investment Platform

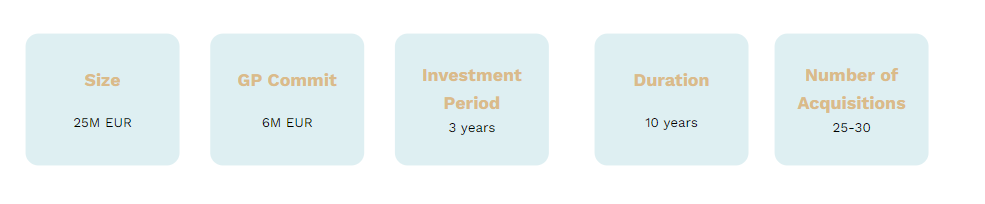

Fund Characteristics

Fund Strategy

About Swanlaab Venture Factory SGEIC

Swanlaab Venture Factory is a unique Venture Capital firm in Spain with a team that has an immensely broad and deep experience in startup investments in Spain and Israel for over 30 years. They have invested in diverse sectors such as B2B Software and Agro Tech.

The Swanlaab team consists of professionals who have founded and led their own startups, managed renowned VC funds, and served as advisors and consultants to launch over 200 companies into the market. Their clear purpose is to help Spanish entrepreneurs succeed on a global level.

Strategy

Taking advantage of succession issues, Scipio invests in Search Funds and acquires growing, profitable and consolidated SMEs directly and through its investment fund.

SME Succession Issues

Increasingly, successful family-owned businesses are facing succession issues. The founders are looking to retire and move-on but don’t have anybody to take over. Scipio takes advantage of this global trend by matching talented leaders with business owners to access attractive growing assets at extraordinary prices.

Share of SMEs facing Succession Issues

Serial Acquisition

Scipio is a serial acquirer. It seeks to grow its business through the sequential acquisition of companies with a commitment to long-term ownership. In our approach, the emphasis is placed on patient and thoughtful investment strategies rather than quick, profit-driven gains. We believe in holding businesses for extended periods to maximize returns and foster sustainable growth. By adopting this patient capital mindset, we aim to create enduring value and contribute to the long-term success of the acquired companies. In essence, Scipio's serial acquisition strategy is not just about immediate financial gains; it's a deliberate and personalized approach to building a resilient and successful business ecosystem over time

Decentralised Organisation

Scipio manages its acquisitions in a decentralized way. It has built a network of autonomous units and promotes flexibility and seamless integration. Each unit has the autonomy to adapt to its market dynamics, allowing for efficient acquisitions without disrupting the overall structure. This model encourages innovation and efficient resource allocation, enabling talented individuals to thrive within an environment that values individual contributions and collective success

Search Funds

As part of its acquisition strategy, Scipio invests in Search Funds. The term “search fund” originated at Harvard Business School in 1984, was popularized at Stanford in the following 10 years.

A Search Fund consists of an individual or team who will spend up to two years trying to find a company to acquire and subsequently run. A typical search fund consists of 4 phases

Search Fund Process

Accessing Difficult to Find Opportunities

Search Funds -- by decentralising deal sourcing -- solve the fundamental challenge that while there are many, many SMEs that have a history of generating profits and cashflow, most do not make good investments and an investor needs to review hundreds of companies to find a single good acquisition target.

Historic Returns

Search Funds access acquisition opportunities not easily available to traditional investors which leads to acquiring great assets at extraordinary prices which delivers superior returns. With an aggregate IRR of over 35% and aggregate MOIC of over 5x, Search Funds are the highest performing asset class over the last 30 years

Scipio Swanlaab SF SCR

To drive its Search Fund investment strategy, Scipio has partnered with Swanlaab Venture Factory SGEIC to launch a Global Search Fund Investment Platform

Fund Characteristics

Fund Strategy

About Swanlaab Venture Factory SGEIC

Swanlaab Venture Factory is a unique Venture Capital firm in Spain with a team that has an immensely broad and deep experience in startup investments in Spain and Israel for over 30 years. They have invested in diverse sectors such as B2B Software and Agro Tech.

The Swanlaab team consists of professionals who have founded and led their own startups, managed renowned VC funds, and served as advisors and consultants to launch over 200 companies into the market. Their clear purpose is to help Spanish entrepreneurs succeed on a global level.